Condo Insurance in and around Santa Ana

Unlock great condo insurance in Santa Ana

Condo insurance that helps you check all the boxes

Home Is Where Your Heart Is

When it's time to recharge, the retreat that comes to mind for you and your favorite peopleis your condo.

Unlock great condo insurance in Santa Ana

Condo insurance that helps you check all the boxes

Agent David Reyes, At Your Service

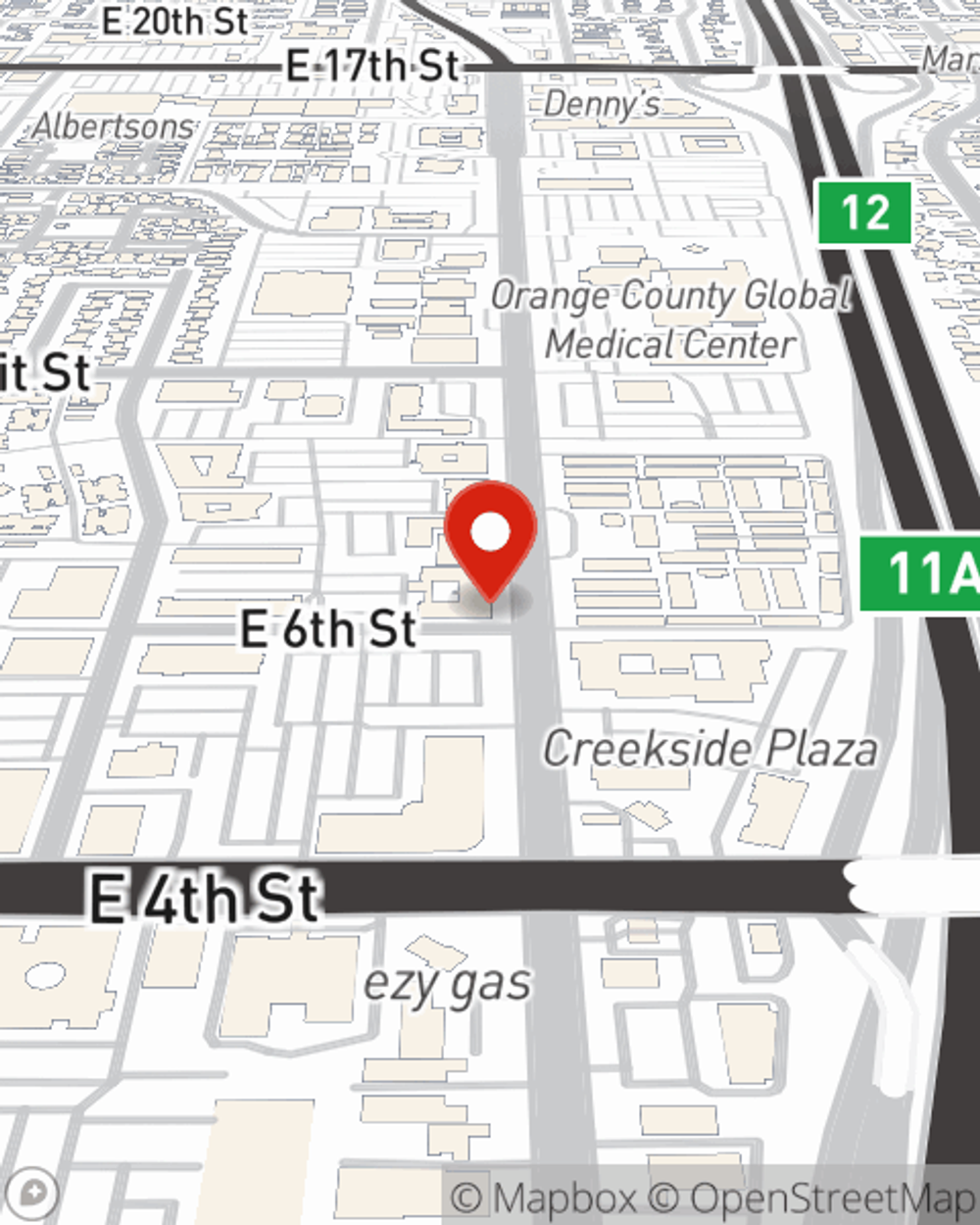

That’s why you need State Farm Condo Unitowners Insurance. Agent David Reyes can roll out the welcome mat to help provide you with coverage for your particular situation. You’ll feel right at home with Agent David Reyes, with a hassle-free experience to get dependable coverage for your condo unitowners insurance needs. Personalized care and service like this is what sets State Farm apart from the rest. Agent David Reyes can help you file your claim whenever the unforeseen lands on your doorstep. Home can be a sweet place to be with State Farm Condominium Unitowners Insurance.

Insuring your condo with State Farm can be the right thing to do for your home, your loved ones, and your belongings. Get in touch with David Reyes's office today to explore how you can save with Condo Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call David at (714) 285-0155 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

David Reyes

State Farm® Insurance AgentSimple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.